See PayoffLab in Action

Explore interactive demos of structured product design, from drawing payoff diagrams to generating optimal derivative strategies with AI-powered analysis.

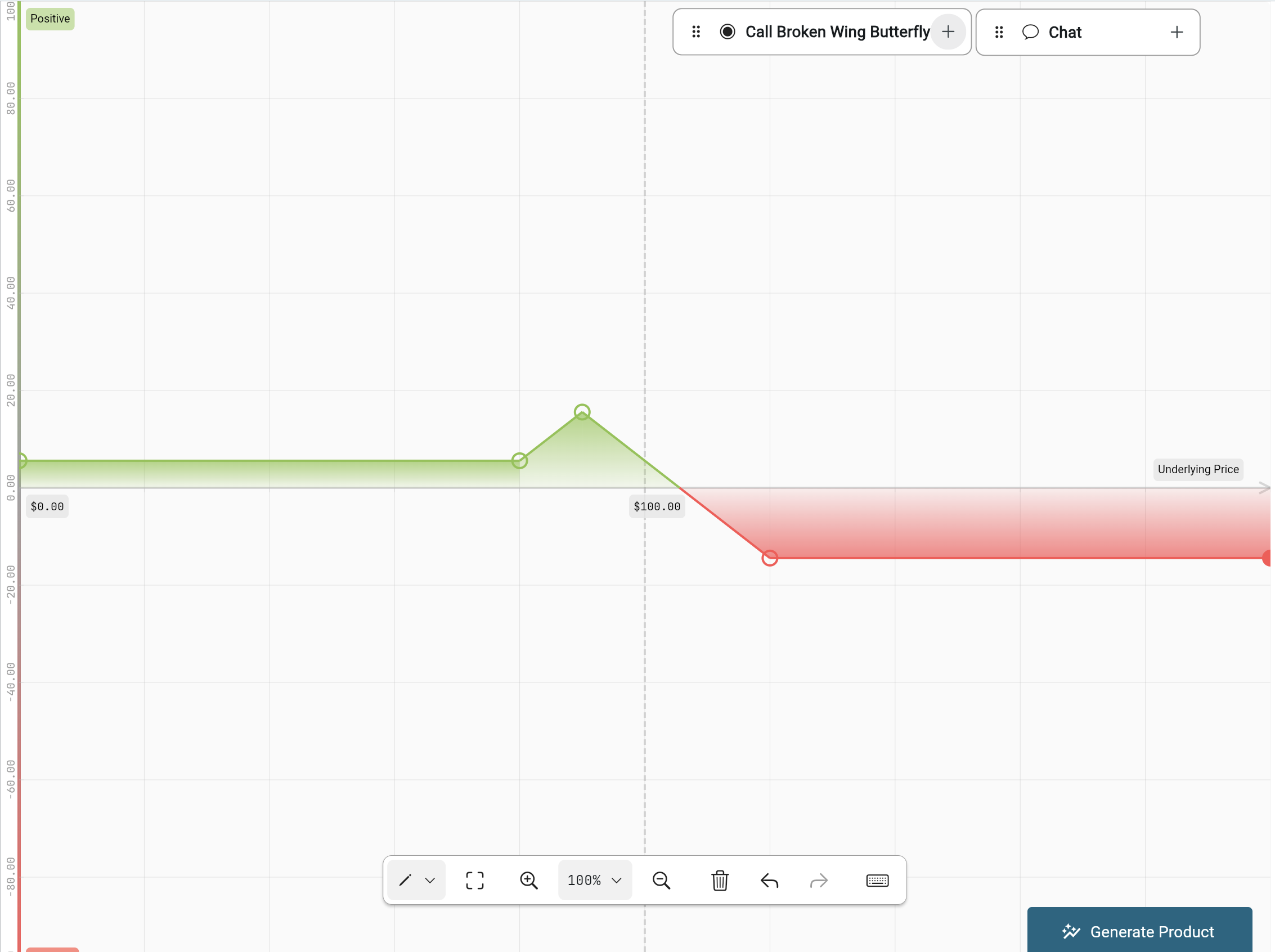

Try AppVisual Payoff Designer

Draw your desired payoff diagram using intuitive drag-and-drop tools. Watch as PayoffLab instantly generates optimal derivative strategies to achieve your target payoff profile.

- Draw payoffs with mouse or touch

- Instant strategy generation

- Real-time cost calculations

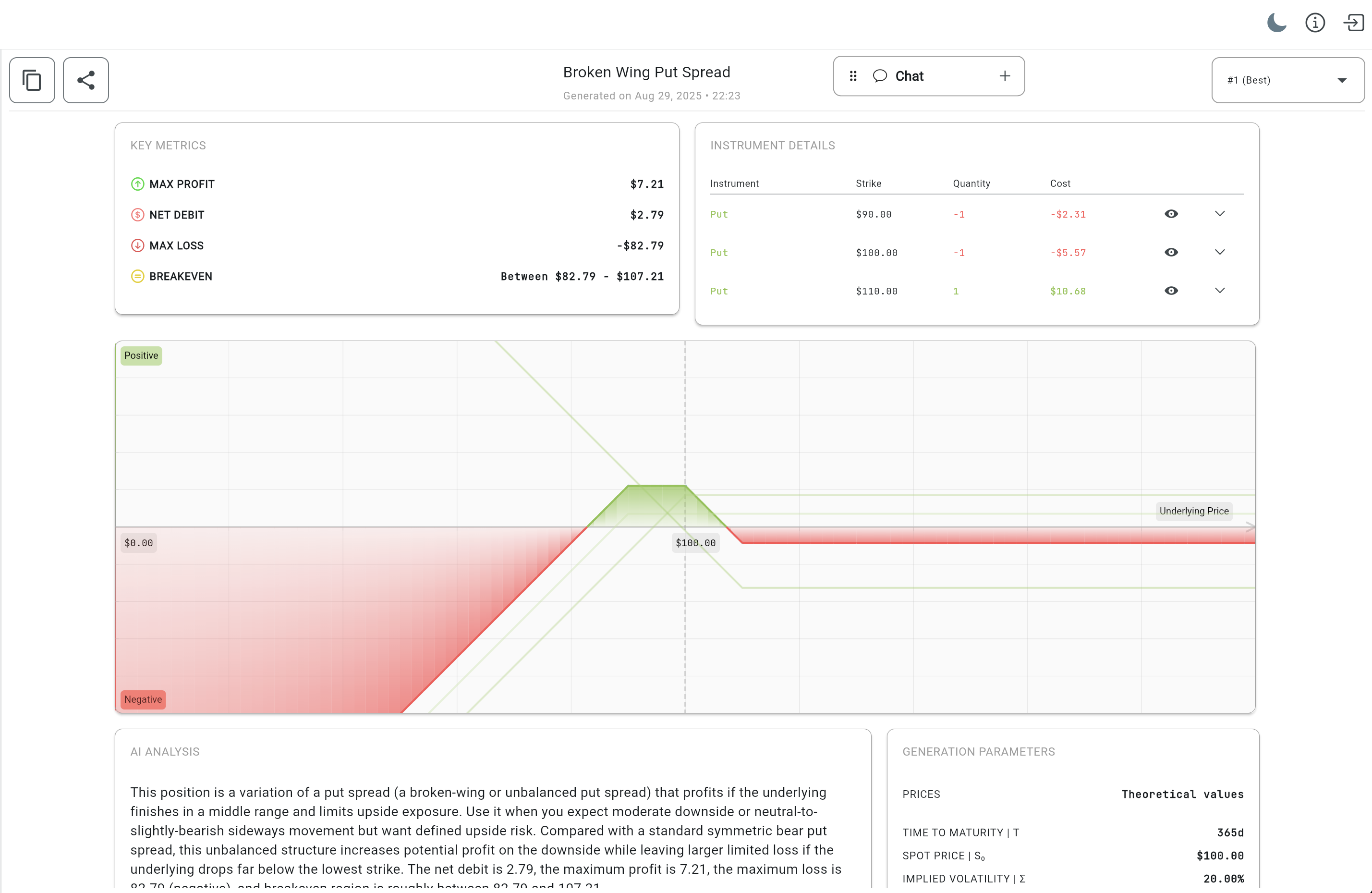

AI Strategy Generation

Once you've drawn your payoff, our AI instantly analyzes your diagram and generates multiple derivative strategies to achieve it. Compare costs, risks, and implementation approaches side-by-side.

- Multiple strategy options

- Cost and risk comparison

- Interactive instrument details

Example Structured Product Strategies

See how different professionals design and analyze structured products with PayoffLab

Bull Call Spread Strategy

Bullish strategy with capped upside and downside. Buy low strike call, sell high strike call. Perfect for moderate bullish outlook.

View Strategy

Iron Condor Strategy

Neutral strategy for range-bound markets. Profit from low volatility with defined risk and reward parameters.

View Strategy

Protective Put Strategy

Portfolio insurance strategy. Own stock and buy put for downside protection while maintaining unlimited upside potential.

View Strategy

Long Straddle Strategy

Volatility strategy that profits from large price movements in either direction. Buy call and put at same strike and expiration.

View Strategy

Collar Strategy

Cost-effective hedging strategy. Own stock, buy protective put, sell covered call to reduce or eliminate hedging costs.

View Strategy

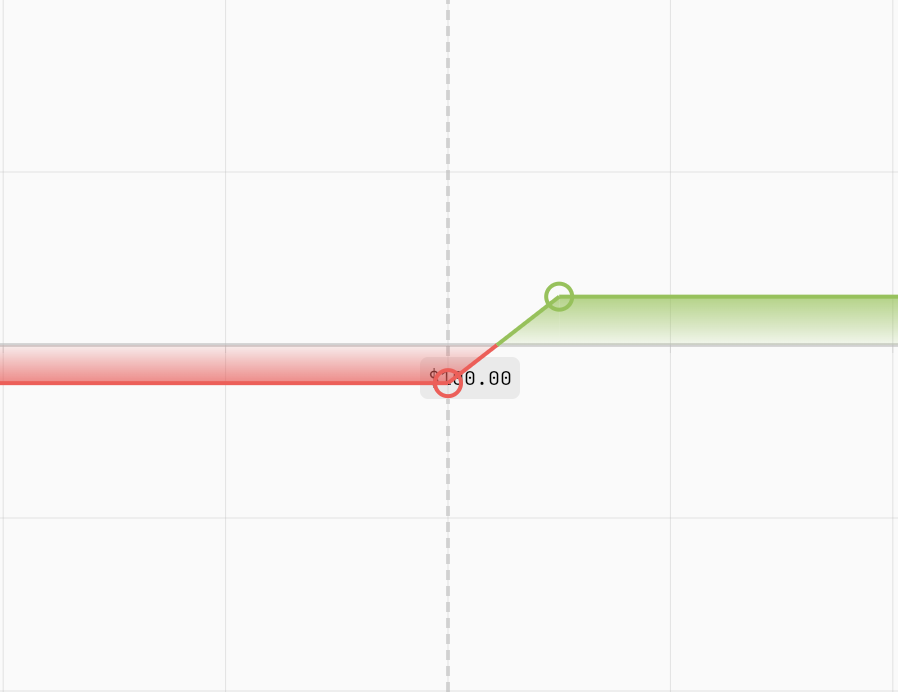

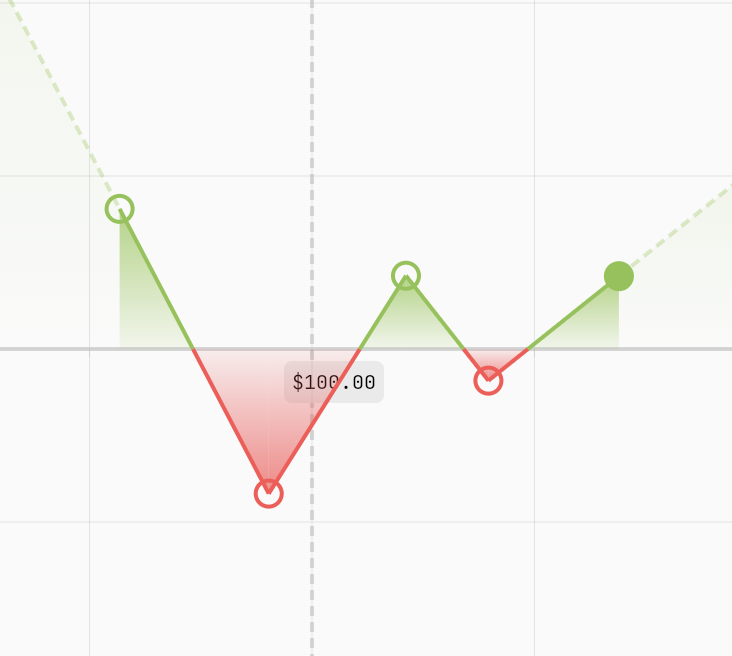

Custom Strategy Builder

Draw any payoff diagram you can imagine and let our AI find the derivative combination to achieve it. Unlimited creative possibilities.

Try BuilderReady to design your first structured product?

Draw your payoff diagram and let our AI find the optimal strategy combination.